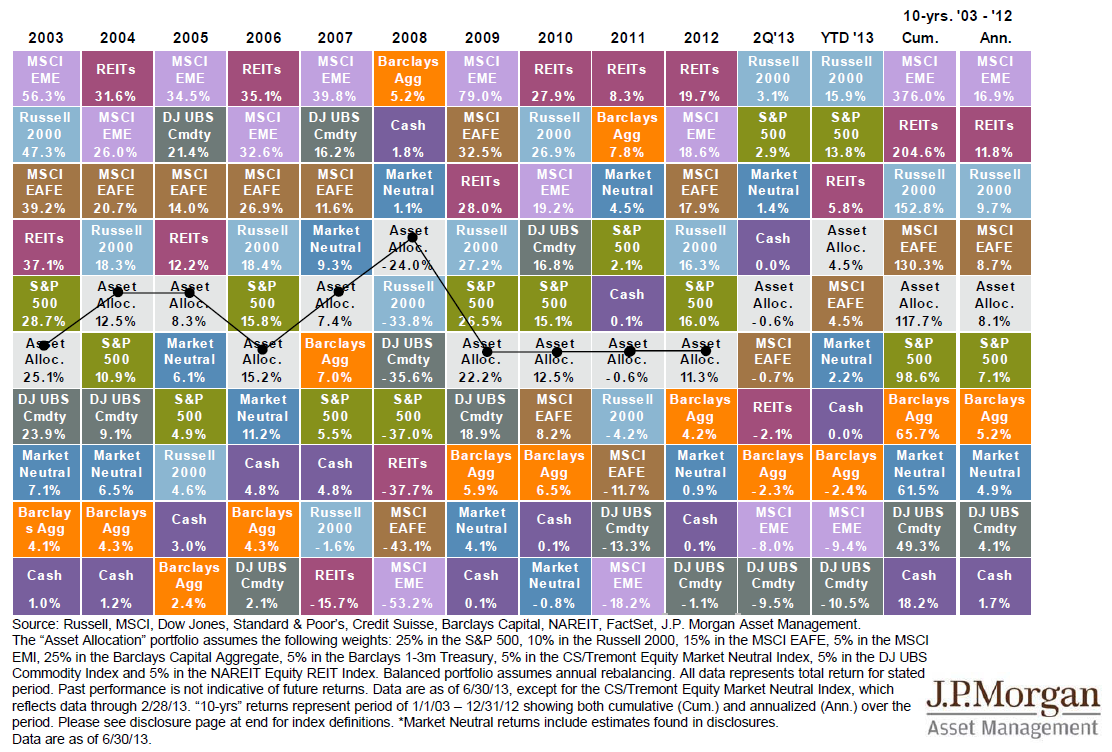

Note that this is as of end of June so its a tad out of date. But its interesting primarily to see a few things:

1 - Asset allocation (mixture of various assets) vastly underperformed the US stock market (4.5% vs 13.8%)

2 - Intl stocks were a big loser along with commodities (3 yrs running now), emerging markets (near bottom for 2 out of last 3 yrs) and bonds (below avg for 2 yrs runing)

No comments:

Post a Comment