Fundamentally, the concept is that if you have a given # of points, you'll always be able to fit a line through it if the # of line parameters is equal to the number of points. For example, 2 points can easily be described by a line of slope a and intercept of b, 3 points by a, b, c, and so on.

So right now, the market looks a bit on the fence by various indicators from number of different sources.

Are we being overly bearish?

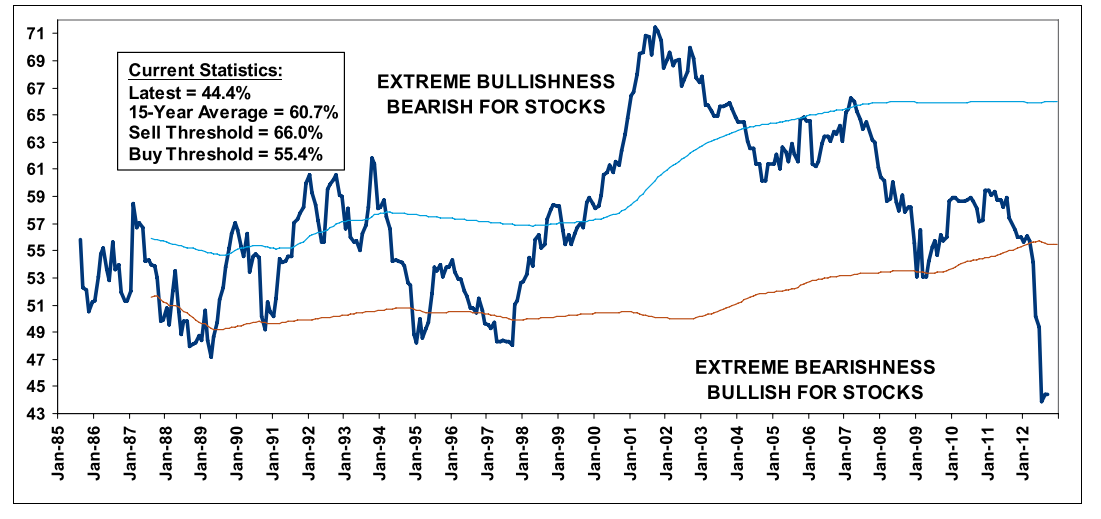

1) According to Merrill Lynch via The Big Picture, we're at a record low for stock bullishness. The chart below is pretty shocking really, as we're far below the normal lows of 48-49. I have a hard time believe this chart as equity values are just so high considering the fundamentals. We're nowhere near the low P/Es during the crash. Hell, according to this, the Mar 2009 lows were just barely below average from 1985-2000.

2) From Reuters (via The Big Picture): Fidelity's bond/money market assets have surpassed its equity assets. Why is this a big deal?

Way back in the Summer of 2003, I wrote a report that analyzed the Contrary Indicators 2000 – 2003 Bear market. It consisted of both internal and external signals that strongly suggested that the 2000 crash was over, and it was safe to get back into equities.

The second of the external signals was that PIMCO’s Total Return Bond fund had surpassed the Vanguard S&P500 fund to become the largest mutual fund (as of October 2002) in the world.

The PIMCO vs Vanguard observation was noteworthy in October 2002, when Bonds surpassed Equities as the bottom of a brutal crash was occurring. The technical types will point out markets were tracing a double bottom, with March 2003 holding near the October lows setting up the start of the next leg higher.

Now that Stocks have been eclipsed by bonds at Fidelity, are we approaching a very similar moment? The key difference is that markets are up 100% over the past 3 years, not down 81%, like the Nasdaq was in October 2002. Regardless, this is an interesting contrarian sign; it suggests to me we are closer to the end of the secular bear that began in March 2000 than we are to the beginning.

3) From Bespoke Invest: The S&P 500 10-Day Advance Decline line is oversold as its near the lows of earlier in the year (though by no means is it the lowest)...

But the absolute price is still very high, as its been trading consistently in the overbought trading range.

4) Looking quickly at the S&P 500 chart:

The market did hit an overbought point and a high shortly after the QE3 announcement. Since then, it has been steadily dropping before taking a big dive last week. However, positive news events swayed the market back a bit such that its no longer plunging down though the positive price trend has yet to be fully established so there's still a chance of further decline. Interestingly, there's a trading channel with 2 potential support lines (see lower blue and lower purple) and the S&P bounced off the higher support line. It remains to be seen whether it'll challenge the support levels again.

Overall, the market performance for both the short and long term is still somewhat inconclusive. As great as it'll be to always have a forecast prediction for where the stock market will go, sometimes its just not going to happen. Unlike many of the talking heads in the sometimes too loud financial world, I'm not going to sit around and recommend something just to fill in the air time. As Warren Buffett says, sometimes you just need to let the cash sit in your wallet until you find something you want to buy. So maybe its time to just hold onto your hats (do people really wear hats nowadays?) and wait it out a bit.

No comments:

Post a Comment